The Of Small Business Accountants

Wiki Article

What Does Small Business Accountants Mean?

Table of Contents10 Simple Techniques For Small Business AccountantsHow Small Business Accountants can Save You Time, Stress, and Money.Small Business Accountants Things To Know Before You BuySmall Business Accountants for Beginners

An additional major advantage of hiring an accountant is that they are experienced in analyzing where a business stands on a monetary level. This aids companies make educated financial choices. Since accounting can be highly tiresome, working with an accountant liberates more time for you and your employees to invest in your main duties (small business accountants).

Considering that the software an accountant utilizes is vital to their capability to finish their jobs in a timely and also reliable fashion, you should constantly ask your prospects which sorts of software program they are experienced in. If you currently have software application that you desire them to make use of, you should ask if they have experience making use of that program or similar ones.

Whether you employ an accountant, an accountant, or both, it is essential that the individuals are qualified by requesting for client recommendations, examining for qualifications or running testing examinations. Bookkeepers "might not constantly be licensed and also the obligation is more on experience," kept in mind Angie Mohr in an Intuit blog post. Not certain where to start? Visit our guide to selecting a business accountant.

Examine This Report about Small Business Accountants

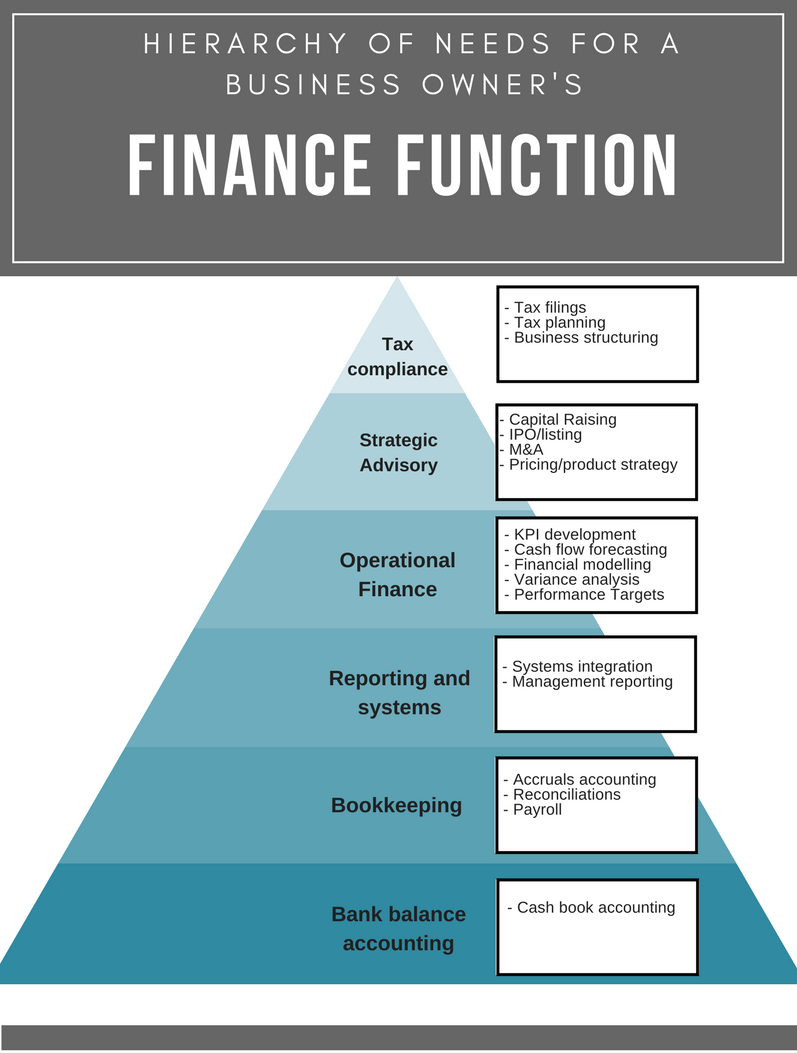

They can help your business interact with the government in other means. Complete and also file the required lawful and also compliance files for your service, Keep your firm approximately day with the most up to date tax laws, Prepare yearly statements of accounts, Maintain your company's status upgraded in the federal government's business register, Maintain records of supervisors and various other administrative workers, Organise as well as record share/stock appropriation, such as when business is developed when a company partner leaves or a new partner signs up with, Handle your payroll and also guaranteeing that all employees' tax obligation codes and also settlements are videotaped properly.That is if those clients had not waited so lengthy to request for help. The bottom line is that there are numerous vital times in the course of your service when you do not intend to wing it without an accountant. Creating Your Company, The formation of your company is one of those crucial times.

Conformity and also Tax Concerns, Even if your business strategy is created, you have actually all the needed authorizations and also licenses, as well as your accounting software application is brand-new and glossy as well as all set to go you're not fairly prepared to move forward without an accountant. There are still dozens of conformity stumbling blocks to get rid of.

Sales tax compliance in the US is swiftly ending up being a headache. If you'll be delivering your items out of stateor in some cases, even within the same stateyou'll wish to see to it you adhere to all the applicable tax legislations. There are apps to assist with this on a recurring basis, yet you'll desire an accountant to aid you obtain whatever established.

The smart Trick of Small Business Accountants That Nobody is Talking About

Wage as well as labour compliance concerns can sink even one of the most successful companies. Similar to sales tax look at more info obligations, there are apps and programs that can assist you with compliance on an ongoing basis, but you'll desire an accounting professional to look over your shoulder at the very least quarterly. Various other coverage requirements. These can be demands for creditors or licensing agencies.Entering transactions: Transactions got in might include sales made, cost of products purchased, employee payment and also benefits, hrs worked, rent out, IT, insurance, office products, and other expenses paid. Reporting real outcomes or the forecasts of future results: Records may cover the standing of possible consumers, sales made, sales made where customers have not yet paid, expenditure comparisons with the budget plan and also same period last year, all type of tax records, economic statements, as well as information required to please small business loan agreements.

The three options are to do it on your own, designate someone on your team to do it or to outsource to a bookkeeper or accounting professional. Usually with a start-up, you are the only employee, as well as there are minimal funds readily available, so initially, the founder regularly does all the accounting. As quickly as you have adequate optional funds, you can think about outsourcing the task.

You can likewise place advertisements in your local paper, on Craigslist or other such forums, or go to the American Institute of Professional Bookkeepers. Don't Outsource It and Neglect It (small business accountants). Consider outsourcing to an accounting professional and/or bookkeeper if you do not have the time, abilities, or disposition to do this work.

The smart Trick of Small Business Accountants That Nobody is Discussing

Perhaps half the accountant's time is spent servicing the 'paperwork' the company is continually producing worrying its revenue and expenses, as well as possibly the other half of his time is invested in assessment with you on accounting strategy. This will certainly include his guidance, based on the financials, on just how to finest invest your company's cash on resources needed to keep business profitable.

It might cost you a couple of hundred dollars, however that's a small financial investment taking into account the influence an accounting professional can have find out this here on your little company. And also if you desire to be among the 89% of entrepreneur who see a bump from useful content dealing with a monetary pro, then start your search for an accountant currently.

Report this wiki page